Lithium Battery Cell Price Increase in 2026 | Rising Raw Material Costs & OEM ODM Solutions

Jan 12, 2026

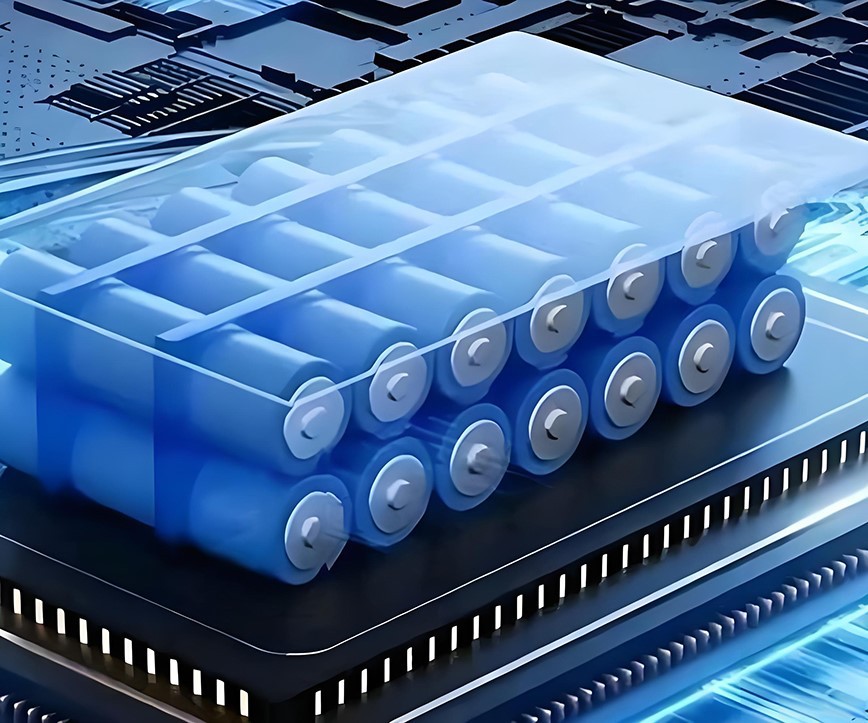

Battery Cell Prices Enter an Upward Cycle: Raw Materials Strengthen Across the Board, and the Lithium Battery Industry Ushers in a New Round of Price Increases.

Recently, the lithium battery industry chain has received a clear and undeniable signal-battery cell costs are systematically rising, and price increases have become a trend, not just a short-term fluctuation. From raw materials and policies to end-user purchasing patterns, multiple factors are jointly driving battery cell prices into a new upward cycle.

According to the commodity spot price index published by KaiPanLa software, various lithium battery-related raw materials have shown significant increases since December 2025. Core materials such as industrial lithium carbonate, battery-grade lithium carbonate, and lithium hydroxide have all seen double-digit percentage increases, even approaching 50%, over different periods of the past 5, 10, and 20 days. Especially during the period from mid-December 2025 to early January 2026, the lithium carbonate-related index ranked among the top in spot price increases, sending a strong signal of rising costs.

Looking at the longer term, and considering the raw material price trends over the past five years published by authoritative non-ferrous metals websites, it can be seen that lithium resources themselves have a distinct cyclical nature. This current increase is not a single event, but a structural rebound against the backdrop of supply and demand rebalancing and the continuous expansion of global new energy demand. The industry generally expects that in the next 1-2 years, the overall price of core raw materials for lithium batteries will continue to rise, and the price center will be unlikely to fall back to previous low levels.

At the same time, policy changes have further amplified cost pressures. China has officially canceled the export tax rebate policy for batteries, meaning that battery manufacturing and export links will no longer enjoy the original tax buffer. After the cancellation of the tax rebate, the relevant taxes and fees will be directly included in the cost, providing substantial support for battery cell prices. For customers primarily engaged in exports and OEM/ODM, this change will directly affect future procurement budgets and delivery costs.

Under the dual impact of rising raw material prices and policy adjustments, battery cell manufacturers face the reality that: without price increases, profit margins will be rapidly compressed; with price increases, it becomes an industry consensus. It is foreseeable that subsequent battery cell quotations will show a "phased, model-by-model, gradual increase," especially for power batteries, energy storage batteries, and high-consistency battery cell products, where price adjustments may be even more significant. In this market environment, we must remind our customers: if you have a clear procurement plan or project implementation timeline, please place your order as soon as possible to secure capacity and pricing. Waiting and watching will likely cause you to miss the current relatively manageable window of opportunity; subsequently, prices will not only be higher, but delivery times will also become more constrained.

As a world-renowned battery brand manufacturer, ONESUN always stays at the forefront of the industry chain, closely monitoring raw material trends and policy changes. Leveraging our mature supply chain system and large-scale manufacturing capabilities, ONESUN can provide global customers with comprehensive OEM and ODM lithium battery solutions, covering power batteries, energy storage batteries, and various customized application scenarios. In the current upward price cycle, ONESUN will do its utmost to secure reasonable cost ranges for our customers, assisting them in planning ahead and ensuring stable delivery.

Industry cycles are unavoidable, but choosing a reliable partner can effectively reduce uncertainty. The increase in battery cell prices is no longer a question of "whether it will happen," but rather "when and by how much." Taking action now will allow you to gain a competitive advantage in the next stage of market competition.

Article Source: Lithium battery manufacturer - ONESUN China

Featured Recommendations:72v lithium battery pack , communication rack battery , complete solar kits ,solar power station , portable solar generator , liFePO4 solar battery ,off-grid solar systems